33+ First time homebuyer down payment

Last week Bank of America announced new zero down payment loans for first time homebuyers in predominantly Black and Hispanic neighborhoods. Savings Include Low Down Payment.

Poll Suggests Parents Are Not Only Helping With Buying Homes But Also Rent R Personalfinancecanada

Programs and grants are available to help you with your down.

. However coming up with a sizable down payment can feel like an impossible task. Assistance funds worth up to either 5500 or 3 of the purchase price 1000 maximum whichever is greater to be. Apply Now With Rocket Mortgage.

Find a mortgage specialist learn more about your rural home financing options today. That is especially true when many lenders desire 20. The Texas Homebuyer Program can help provide down payment and closing costs available in the form of a zero percent interest 2nd loan that remains silent and requires no monthly payment.

Trust your home loan to Compeer. Borrower does not need to be a first-time homebuyer. The Florida Assist FL Assist Offers up to 10000 on FHA VA or USDA loans and 7500 on Conventional Loans.

Join thousands of rural homebuyers who save every year with the benefits of a USDA loan. Ad Check Your FHA Mortgage Eligibility Today. The average first-time homebuyer down payment 6 across all states is 12274.

There are many first time home buyer programs and grants available to you to help you make your first real estate purchase. Were Americas 1 Online Lender. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

The first-time homebuyer down payment is often misunderstood but nonetheless important for prospective owners to comprehend. Looking For A Mortgage. Ad Apply today for a USDA home loan.

If youre looking at a 500000 mortgage thats. The Home Plus Loan Program is available to all home buyers. Well Help You Find A Home Loan.

FHA Loans More. For example the Chenoa Fund is. Ad We know rural home financing inside out.

The 25000 Downpayment Toward Equity Program Expected in 2022. That means the real answer depends on how much you intend to borrow. The Michigan State Housing Development Authority MSHDA offers a few different home buyer assistance programs.

Its A Match Made In Heaven. This type of mortgage requires a fixed-rate loan. Current MHFA down payment assistance rate as of July 1 2022 is 600 and APR 623 based on sample loan of 280000 purchase price 3 down payment conventional 30-year fixed 1000.

Michigan Down Payment Assistance Programs. The FL Assist down. Most low-down payment conventional loans as well as the 35 percent-down FHA loan carry mortgage insurance.

Ad Shop For Your Personalized Mortgage Rate With The Help Of Flagstar Bank. If you qualify for a VA loan you wont need a down payment. Contact a Loan Specialist to Get a Personalized FHA Loan Quote.

Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Once you know that amount youll have a target to save for35 for a down payment and at least another 3 for. Felton describes that conundrum as the poor pay more.

Few aspects of a purchase after all will actually have. The idea of buying a first home is exciting. Be In Control Of Your Mortgage Application With Our Simple 3-Step Process.

Ad We know rural home financing inside out. Delve into down payment assistance. If you have a.

0 non-amortizing deferred second mortgage. One of the most popular financing options for first-time buyers is an FHA loan which is offered by a traditional mortgage lender but backed by the government. In 2021 Congress introduced a bill titled The Downpayment Toward Equity Act a home buyer grant for.

A down payment is a lump sum calculated as a percentage of a mortgage and is conventionally about 20 percent of the total borrowed amount. You dont have to be a single parent to qualify for down payment assistance. Find a mortgage specialist learn more about your rural home financing options today.

Ad Ready to Begin. Conventional FHA VA and USDA fixed. Ad Compare Mortgage Options Calculate Payments.

But almost every other loan type including an FHA loan will require you to make a down payment. First-time homebuyers and individuals with incomes. You may be eligible for 0 down and no PMI.

Trust your home loan to Compeer. First-time homebuyers are expected to pay an average of 1983 in closing costs on top of a down. Home buyers do not have to be a first-time home buyer to qualify.

A down payment of 20 on a 400000 home would be. The homebuyer must occupy the property as a primary residence. In addition to loan programs that have a low down payment requirement there are first-time homebuyer down payment assistance programs.

Guilds Zero Down program pairs a standard FHA first mortgage for up to 965 of the total purchase price plus second mortgage options to go toward down payment and.

Avoid Foreclosure Moshes Law Firm 888 445 0234

Basic Rental Agreement Download Free Printable Rental Legal Form Template Or Waiver Lease Agreement Rental Agreement Templates Lease Agreement Free Printable

Moving Checklist 4 Week Countdown Wheaton Moving House Tips Moving Tips Moving House

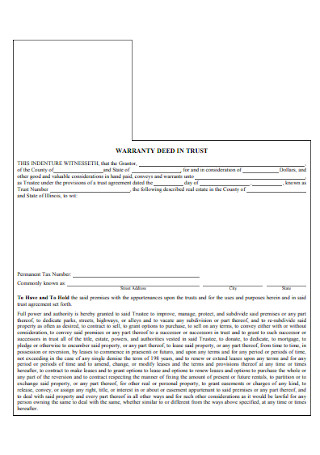

2

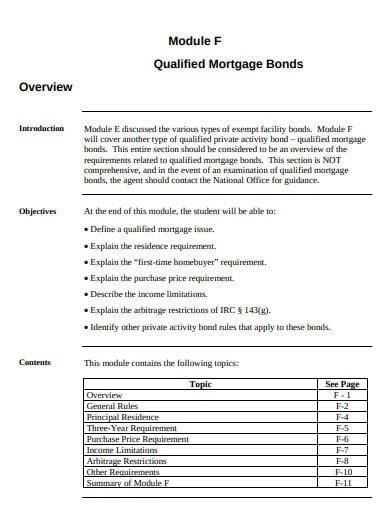

33 Sample Deed Of Trusts In Pdf Ms Word

A38vn8oybt26pm

Benton Homes For Sale Benton Tn Real Estate Redfin

11 Mortgage Bond Templates In Pdf Doc Free Premium Templates

The Home Buying Process In 10 Simple Steps Great Tips For First Time Home Buyers Realestate Home Buying First Home Buyer Buying First Home

Tammy L Smith

33 Sample Deed Of Trusts In Pdf Ms Word

Poll Suggests Parents Are Not Only Helping With Buying Homes But Also Rent R Personalfinancecanada

Sierra Pacific Mortgage Reviews

Benton Homes For Sale Benton Tn Real Estate Redfin

Sharon Fincham Team Lead The Dallas Fincham Team Linkedin

Pin On Naca Event Locations

2230 Mill Rd Binghamton Ny 13903 Mls 318144 Howard Hanna